by Dan Mitchell

Yesterday, in Part I of our series about greedy state politicians, we looked at top income tax rates.

The worst state, not surprisingly, was California with a top tax rate of 13.3 percent.

This onerous tax rate, combined with low-quality government and absurd levels of red tape, helps to explain why so many people have fled the Golden State.

(And because California’s problems are self-inflicted, that’s the biggest reason why the state should not get a bailout from Uncle Sam.)

Today, we’re going to look at another major source of tax revenue for state politicians.

Here are some excerpts from the Tax Foundation’s report on sales tax rates.

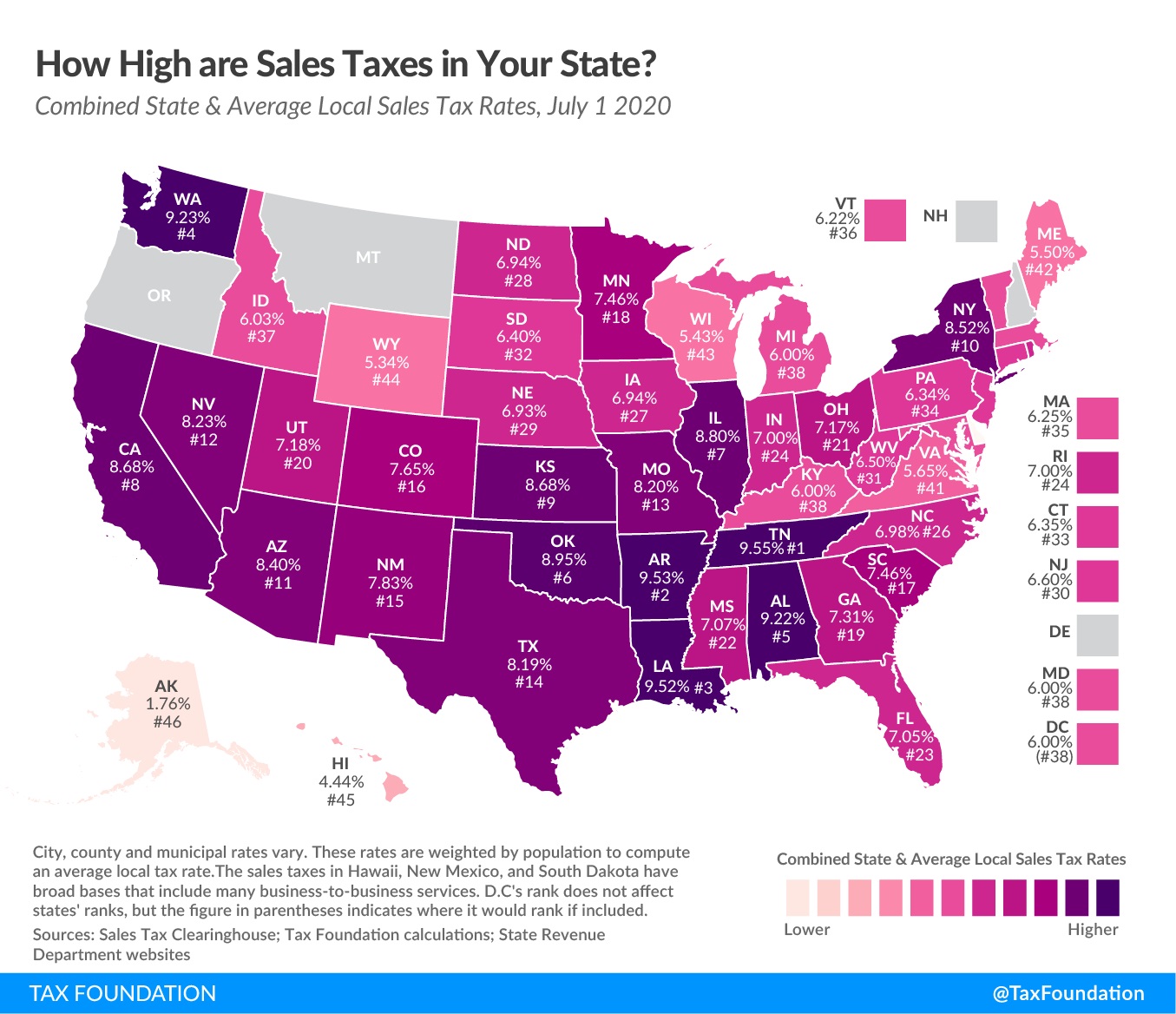

While graduated income tax rates and brackets are complex and confusing to many taxpayers, sales taxes are easier to understand; consumers can see their tax burden printed directly on their receipts. In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate compared to other states. This report provides a population-weighted average of local sales taxes… Five states do not have statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, Alaska allows localities to charge local sales taxes. The five states with the highest average combined state and local sales tax rates are Tennessee (9.55 percent), Arkansas (9.53 percent), Louisiana (9.52 percent), Washington (9.23 percent), and Alabama (9.22 percent). The five states with the lowest average combined rates are Alaska (1.76 percent), Hawaii (4.44 percent), Wyoming (5.34 percent), Wisconsin (5.43 percent), and Maine (5.50 percent). California has the highest state-level sales tax rate, at 7.25 percent.

Here’s the map that accompanied the report.

It’s good to be gray. By contrast the states with the darkest colors have the most onerous rates.

As noted in the excerpt above, Tennessee, Arkansas, Louisiana, and Washington have the greediest politicians, at least measured by sales tax rates.

But this is the point where it makes sense to merge today’s map with yesterday’s map. Because Tennessee and Washington don’t impose income taxes, while Louisiana and Arkansas both make that mistake.

And if you combine the tax rates from both maps, you’ll find that Tennessee and Washington are relatively low-tax states while Louisiana and Arkansas are relatively high-tax states.

So one of the lessons to be learned is that it’s never a good idea to give politicians multiple sources of revenue (something to remember every time greedy officials in D.C. broach the idea of a value-added tax).

But let’s keep our focus on the main topic, which is identifying the state with the greediest politicians?

If we continue with the methodology of combining the numbers from both maps, California easily ranks as the worst state, with a combined rate of 21.98 percent.

Indeed, it has a huge lead compared to the next-worst states (New York, New Jersey, and Minnesota), all of which have combined rates of between 17-18 percent.

What’s the best state?

Depends on the approach. If you count only wages and salaries, then New Hampshire wins with a combined rate of 0.0 percent. But if you include New Hampshire’s unfortunate policy of imposing income tax on interest and dividends, then Alaska wins with a combined rate of 1.76 percent.

Wyoming, South Dakota, and Florida also deserve applause. Those states are ranked #3, #4, and #5 because they have no income taxes and also manage to keep sales taxes at semi-reasonable levels.

P.S. Alaska and Wyoming both collect large amounts of energy taxes, so their good scores don’t necessarily reflect a commitment to low overall tax burdens.

Daniel J. Mitchell is a public policy economist in Washington. He’s been a Senior Fellow at the Cato Institute, a Senior Fellow at the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. His articles can be found in such publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. Mitchell holds bachelor’s and master’s degrees in economics from the University of Georgia and a Ph.D. in economics from George Mason University. Original article can be viewed here.

Self-Reliance Central publishes a variety of perspectives. Nothing written here is to be construed as representing the views of SRC.